What Are the Key Subjects Addressed in Online Accounting Courses

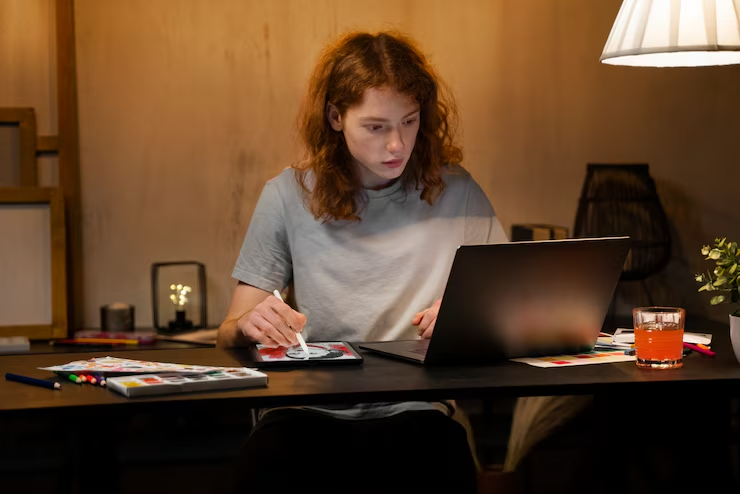

Students are looking for more flexibility and ease in their academic journeys in the current digital era. Due to this change, online learning has become more and more popular, especially for courses like accounting. Online accounting classes provide a wide range of crucial subjects to guarantee thorough learning, regardless of your level of experience from a beginner looking to grasp fundamental financial concepts to an accomplished student pursuing CPA or CMA certificates. Additionally, if you are engaged in other responsibilities, you can request an expert and say, please take my online accounting class for me so that you can help relieve the pressure of balancing work, family, and school while guaranteeing academic achievement.

The Practicality of Distance Education

It makes sense that many students seek outside assistance in handling their studies given the wide range of intricate subjects addressed in online accounting courses. This is where students think about outsourcing their work and ask the experts, can you take my class. The online platforms link students with knowledgeable experts who can help with homework, tests, quizzes, and even finishing a whole course.

For people who are juggling personal obligations, professional pressure, or time limits, it’s a useful option. Additionally, online education enables students to:

- Access lectures from anywhere at any time.

- Communicate with teachers through email and discussion boards.

- Make use of simulation tools and digital textbooks.

- Practice your skills with accounting software.

- Finish their assignments at their own speed.

Online accounting education is economical and successful due to its extensive academic content and flexibility.

Key subjects taught in an accounting course in detail

Let us examine and see why mastering each accounting topic is essential to becoming a proficient accountant.

Overview of Accounting

In every accounting course, the Introduction to Financial Accounting course is one that comes first. This subject prepares pupils for the rest by instructing them on:

- The cycle of accounting

- System of double-entry accounting

- Keeping track of journal entries

- Getting trial balances and ledgers ready

- Putting together financial statements

The goal and format of financial reports such as the income statement, balance sheet, and cash flow statement are explained to learners, along with how to write down business transactions using the generally accepted accounting principles (GAAP).

Accounting Management

Managerial accounting addresses reporting to internal stakeholders, like managers and owners of a firm, while the professional accounting focuses on external reporting. Some of the topics are:

- Estimating and planning

- Comparison of variance and standard costing

- Analysis of break-even

- Accounting for responsibilities and assessing performance

This section is crucial to any online accounting education since it is necessary for the execution of strategic plans and choices.

Advanced and Intermediate Accounting

Students’ progress to intermediate and advanced accounting topics once they have mastered the fundamentals. These modules explore in greater detail:

- Financial statements that are combined

- Transactions using foreign currencies

- Derivatives, pensions, and leases

- Standards for revenue recognition (ASC 606)

- Accounting for fair value

In order to prepare students for certifications like CPA, ACCA, or CFA, these subjects are extremely technical and frequently studied at several levels.

Accounting for Costs

The study of the cost of goods or services is the main objective of the accounting subfield known as cost accounting. It consists of:

- Costing by job order

- Costing processes

- ABC stands for activity-based costing.

- Analysis of variation and standard costs

- Cost distribution and absorption

Cost accounting offers comprehensive cost information to support pricing, evaluations of efficiency, and planning. Students concerned production-based or manufacturing-related fields will find it especially helpful.

Taxes

Tax accounting, which covers planning and submitting taxes for people and companies alike, is another important subject. Students research:

- Federal income taxation

- Partnership and corporation taxes

- Local and state taxes

- Tax credits and deductions

- Techniques for tax planning

- Filing processes with IRS e-file or TurboTax software

Assurance and Auditing Services

One of accounting’s most important and strictly controlled fields is auditing. Being the one of the important subfields, students generally ask for help and say, is there anyone who can take my class so that I can learn this topic individually for some time. Learners in an online course learn how to:

- Perform audits both internally and externally.

- Examine internal control mechanisms.

- Know how to arrange audits and gather evidence.

- Observe auditing standards (PCAOB, GAAS).

- Compose opinions and audit reports.

By guaranteeing the dependability and correctness of financial statements, auditing promotes investor trust and complies with regulations.

Information Systems for Accounting (AIS)

Expertise in Accounting Information Systems is crucial in the modern digital era. This subject includes:

- Accounting system design and implementation

- ERP and database management platforms such as SAP and Oracle

- Data integrity and cybersecurity

- Utilizing software programs such as NetSuite, Xero, and QuickBooks

Students gain knowledge of how to use modern equipment to effectively successfully assess and handle vast amounts of economic information.

Accounting Ethics

This module highlights:

- The Professional Conduct Code

- Governance of corporations

- Handling conflicts of interest

- Reporting wrongdoing and fraud

- The function of associations such as IFAC and AICPA

Students can better grasp the repercussions of unethical behavior, such as misappropriation or financial record tampering by using real-world case studies.

Analysis of Financial Statements

When trying to make decisions about lending, investing, or executives, this subject teaches students how to critically examine financial statements. Important areas consist of:

- Analysis of ratios (solvency, profitability, and liquidity)

- Horizontal and trend analysis

- Vertical evaluation

- Analysis of cash flow

- Statements of common size

With this information, students are able to evaluate an organization’s financial standing and offer stakeholders perspectives.

Global Accounting

Knowing International Financial Reporting Standards (IFRS) is essential in today’s worldwide economy. This module addresses:

- Comparisons of GAAP and IFRS

- Financial statement consolidation on a global scale

- Translation of currencies

- Issues with multinational taxes

- Cross-border purchases and mergers

For students hoping to work for larger corporations or in nations other than the United States, this is essential.

Accounting for Forensics

Examining accounting books for misconduct, theft, and legal problems is the focus of this specialist field. Among the subjects are:

- Methods for detecting fraud

- Encouragement for litigation

- Investigations into financial crime

- Collaborating with administrative and law enforcement agencies

- Forensics of computers

Accounting for Payroll

Compensation for staff members is covered in this hands-on aspect of accounting, which includes:

- Computations of gross salary and net pay

- Revenues and penalties on payroll

- Tax obligations of employers

- Utilizing payroll software, such as ADP or Gusto

- W-2 and 1099 form filing

Employee satisfaction and legal compliance are guaranteed by effective payroll administration.

Accounting and Business Law

Basic business legal principles are integrated into a decent online accounting course. This section contains:

- Law of contracts

- Tort law

- Insolvency and bankruptcy

- Regulation of securities

- Principles of corporate law

To stay out of trouble and follow the law, accountants need to be aware of the legal consequences of their employment.

Case Studies and Capstone Projects

Pupils frequently do culminate tasks or real-world case studies at the conclusion of many online programs. These are intended to:

- Apply your theoretical understanding to real-world issues.

- Examine actual business situations.

- Work together in remote groups.

- Provide thorough financial reporting.

These experiences increase the job prospects of pupils by simulating real-world accounting situations.

Employment Possibilities Following Online Accounting Course Completion

Gaining expertise in these areas opens up a variety of job options:

- A public accountant

- Tax Advisor

- The auditor

- Analyst of Finance

- An accountant for costs

- Manager of Payroll

- A forensic accountant

- Analyst of Budgets

Students can further improve their potential for income and employment chances by obtaining certification (such as CPA, CMA, or ACCA).

In conclusion

A comprehensive curriculum covering key subjects that prepare learners for success in everyday life, an online accounting class is more than simply math and statistics. from basic concepts in finance to complex global standards, each session adds a degree of knowledge that enhances professional competence.

But it can be really hard to juggle online school with responsibilities to your family, work, or other things. In these instances, employing professional services in an effort to pose, can someone take my accounting class for me can be really helpful. When combined with a strong curriculum, these services guarantee that you maintain your academic progress while juggling the responsibilities of daily life.

Whether you’re looking for assistance or delving into fundamental accounting theory, keep in mind that each action you take on your journey of becoming an accounting professional will bring you a single stage closer to a fulfilling job in one of the most important disciplines in humanity.